Posted On Dec 22, 2025

Your bank isn't going to call you up and tell you about the easiest way to slash your monthly debt payments by 70%. They're not going to mention that you could roll all your high-interest credit cards into your mortgage at a fraction of the cost.

Why? Because they make more money when you keep paying those 19.99% credit card rates.

Let's pull back the curtain on what Canadian banks don't want you to know about debt consolidation mortgage Canada options.

WHAT YOUR BANK ISN'T TELLING YOU

Here's the thing most banks won't volunteer: if you have equity in your home, you can likely refinance mortgage Canada style and wipe out your high-interest debt overnight.

You don't need perfect credit to qualify.

You don't need to jump through endless hoops.

You definitely don't need to keep paying those crushing credit card rates.

The process is called mortgage refinancing for debt consolidation, and it's been helping Canadian homeowners save thousands every year. Your bank knows this. They just prefer you don't.

THE REAL NUMBERS THEY DON'T WANT YOU TO SEE

Let's say you're carrying $40,000 in credit card debt across multiple cards. Those cards are charging you anywhere from 12.99% to 22.99% in interest. Your minimum payments are probably around $1,200 per month, and most of that is just interest.

Here's what happens when you consolidate that debt into your mortgage refinance:

$40,000 at 19.99% credit card rate = $1,200+ monthly payments

$40,000 at 4.64% mortgage rate = $400-500 monthly payments

That's a savings of $700-800 every single month. Over five years, you're looking at saving over $40,000 in interest alone.

TIP: The average Canadian saves 70% on their monthly debt payments through mortgage refinancing. That's money back in your pocket every month.

HOW THE "SECRET" ACTUALLY WORKS

Mortgage refinancing for debt consolidation isn't rocket science. You're essentially breaking your current mortgage and replacing it with a new, larger one that includes your existing mortgage balance plus your debts.

Here's the step-by-step:

You tap into your home's equity (the difference between what you owe and what it's worth)

You get a new mortgage that covers your old mortgage plus your debts

Your debts get paid off immediately

You're left with one monthly payment at mortgage rates instead of credit card rates

REMEMBER: You need at least 20% equity in your home to qualify. So if your home is worth $500,000, you need to owe less than $400,000 on your current mortgage.

THE EQUITY RULE BANKS DOWNPLAY

Canadian lenders will let you borrow up to 80% of your home's appraised value when you refinance mortgage Canada for debt consolidation.

Let's break this down with real numbers:

Home value: $600,000

Maximum you can borrow: $480,000 (80% of $600,000)

Current mortgage balance: $350,000

Available for debt consolidation: $130,000

That $130,000 can wipe out credit cards, personal loans, car loans, lines of credit, tax debt, and more. All at mortgage rates instead of the brutal rates you're paying now.

TIP: Get a recent appraisal or comparative market analysis to know exactly how much equity you're working with.

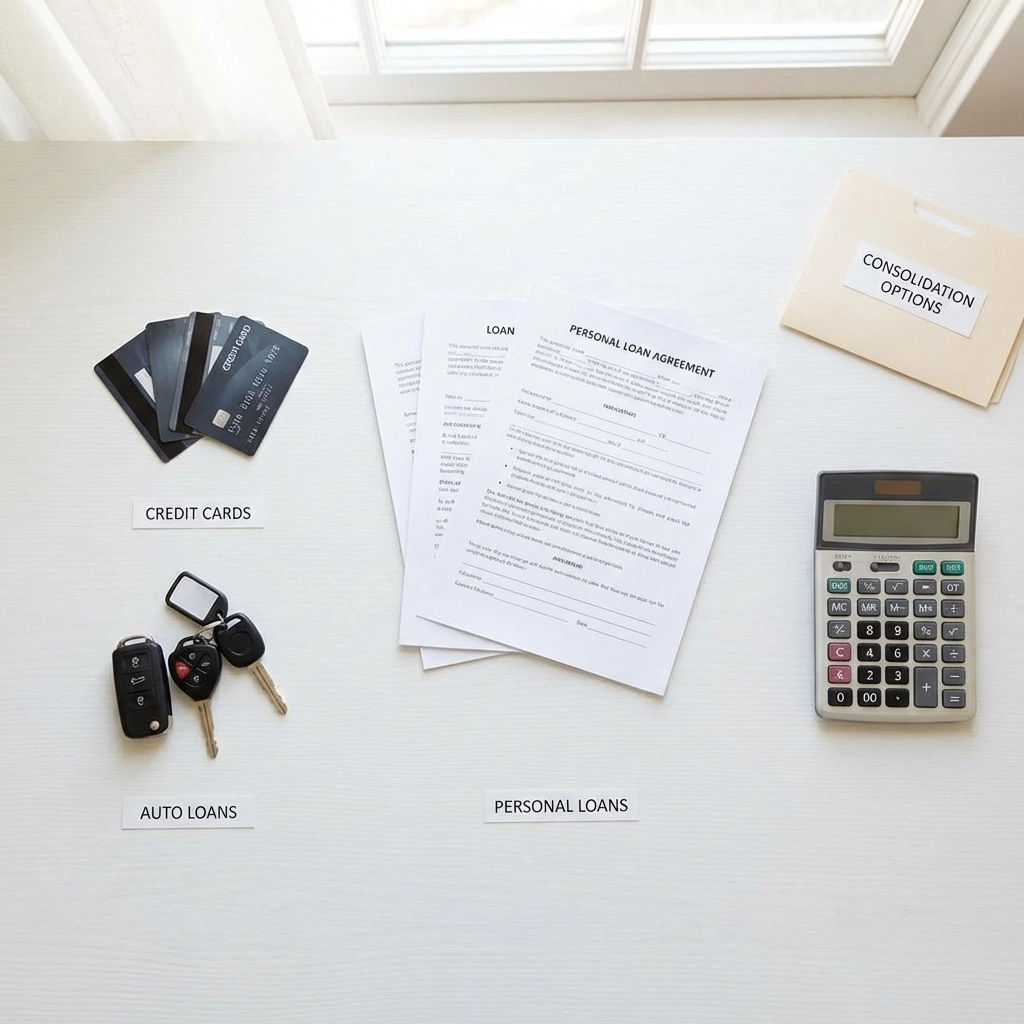

WHAT DEBTS YOU CAN ACTUALLY CONSOLIDATE

Banks won't always volunteer this list, but you can consolidate almost any non-mortgage debt:

Credit card balances

Personal loans

Car loans

Lines of credit

Student loans

Tax debt

Medical bills

Investment loans

The only catch? The total amount can't exceed your available equity (remember that 80% rule).

THE APPLICATION PROCESS THEY MAKE SOUND COMPLICATED

Banks love to make mortgage refinancing sound like climbing Mount Everest. It's not.

You'll need:

Proof of income (pay stubs, T4s)

List of all your debts

Recent mortgage statement

Property tax assessment

Bank statements

A mortgage broker Canada can handle most of this paperwork for you and shop your application around to multiple lenders to get you the best mortgage rates Canada has to offer.

REMEMBER: The whole process usually takes 30-45 days from application to funding.

THE WARNING THEY DEFINITELY WON'T MENTION

Here's the part banks really don't want you thinking about: what happens after your debts are paid off.

When you consolidate $40,000 in credit card debt into your mortgage, those credit cards don't disappear. The balances get paid to zero, but the cards are still there. Still active. Still ready to be used.

This is where people get into trouble.

If you're not disciplined about spending, you could end up with the same credit card debt again, PLUS the larger mortgage payment. That's financial disaster territory.

TIP: Consider closing some credit accounts after consolidation or setting up automatic savings to replace your debt payments.

WHY BANKS PREFER YOU STAY IN DEBT

Let's be honest about something banks will never tell you: they make significantly more money when you carry high-interest debt.

A $40,000 credit card balance at 19.99% generates about $8,000 per year in interest income for the bank. That same $40,000 added to your mortgage at 4.64% only generates about $1,856 per year.

The math is simple. Banks make four times more money when you don't consolidate.

THE REFINANCING ALTERNATIVES THEY WON'T OFFER

Banks typically only offer you their own refinancing products. A mortgage broker Canada with unbiased mortgage advice can show you options from dozens of lenders, including:

Credit unions with lower rates

Alternative lenders with flexible qualification

Private lenders for unique situations

Specialty programs for self-employed borrowers

TIP: Always compare at least three different lenders before making a decision.

IS DEBT CONSOLIDATION RIGHT FOR YOU?

Mortgage refinancing for debt consolidation makes sense if:

You have at least 20% equity in your home

You're paying high interest on multiple debts

You have steady income to support the new payment

You're committed to not running up new debt

It might not be right if:

You're close to paying off your current mortgage

You don't have spending discipline

You're planning to sell your home soon

Your current mortgage has a great rate with high penalties

GETTING STARTED WITH DEBT CONSOLIDATION

Ready to explore your options? Here's what to do next:

- Calculate your home's current value and your equity

- List all your debts and current payments

- Talk to a mortgage broker about refinancing options

- Compare different lenders and programs

- Apply with the best option for your situation

REMEMBER: Every situation is different. What works for your neighbor might not work for you.

The bottom line? Canadian banks aren't going to advertise the easiest way to cut your debt payments in half. But now you know the secret.

Your home equity could be the key to financial freedom you've been looking for.

Want to explore your debt consolidation options? Give us a call and let's see how much you could save every month. We think you'll be pleasantly surprised by what's possible.